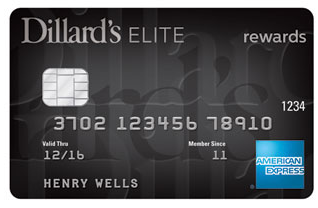

Dillard's Store Card

Dillard's Credit Card is designed for frequent users of Dillard's. Dillard is an American department store chain with about 292 branches in 29 states, headquartered in Little Rock, Arkansas. At present, the largest number of branches are located in Florida, 42, Texas, 57, but there are also 27 states with branches, although there are no branches in the Northeast (North Washington, D.C.). Most of the Upper Midwest (without stores in Michigan, Chicago, Wisconsin or Minnesota), Northwest and California, except for three stores in small cities.