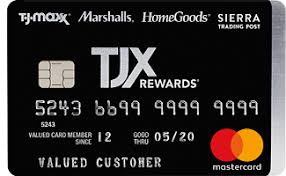

tjx rewards credit card

tjx rewards credit card is a Store Credit Cards.

tjx rewards credit card List

tjx rewards credit card Special Offers

You could win a Designer Handbag.

You could win a Designer Handbag.

Join TJX Rewards Access today, complete your profile and get a sweeps entry for this month's designer handbag sweeps for new members.

Alternatives

If you want more cash back, you can choose Nationwide Credit Card.

Nationwide Credit Card

no longer accepting applications for new credit cards. If you already have a card, no worries—you’ll still be able to use it as normal.

If you want to save money in your common purchases, you can choose Town Bank Cash Back American Express Card.

Town Bank Cash Back American Express Card

- Earn 1.5% cash back on purchases

- Receive a statement credit automatically every time you earn $25 in cash back

- Rewards earned never expire!

- A one-time $50 automatic statement credit when you spend $500 in the first 3 billing cycles

- No Annual Fee

What Credit Cards Are Available? (2)

TJX Rewards® Credit Card

|

TJX Rewards Platinum MasterCard®

|

|

| Sing-Up Bonus | No | No |

| Annual fee | $0 | $0 |

| Benefits | ||

| 10% off your first online or in-store purchase | ✔ | ✔ |

| $10 Rewards certificate for every 1,000 points you earn | ✔ | ✔ |

| 5 points for each $1 of net purchases made with your TJX Rewards credit card at T.J.Maxx, Marshalls, | ✔ | ✔ |

| 1 point per $1 anywhere Mastercard is accepted | ✔ | ✔ |

| Fraud protection | ✔ | |

| Identity theft assistance | ✔ | |

| Price protection | ✔ | |

Information About TJX Rewards Credit Card You Need to Know

TJX Rewards Credit Card can only be used in T.J. Maxx, Marshalls, HomeGoods, and Sierra Trading Post. There is also a similar card, MasterCard, TJX reward platinum MasterCard, which can be used anywhere MasterCard is accepted.

-

There is no limit to the number of rewards you can earn from TJX Rewards Credit Card

Earn 5 points for every $1 spent at T.J.Maxx, Marshalls, HomeGoods, and Sierra Trading Post

-

No annual fee

-

Overall, the advantage of the TJX Rewards Credit Card is that you can get a 10% discount on your first online or in-store shopping.

-

TJ Maxx Credit Cards earn 5 cents for every $1 spent in TJ Maxx, Home Goods, Marshalls, and Sierra Trading Post store in the United States and Puerto Rico. You can also use it where the main card is accepted. If you do that, you'll get a dollar and an extra point. When you earn 1000 points, you can exchange a $10 certificate for any card-related brand. The certificate is not convertible cash, which means that the card is not a real cash refund credit card. Your bonus certificates will also expire in two years, so once you are ready to use them, make sure you only use points - otherwise you may waste points.

Should You Get TJX Rewards Credit Card?

If you spend a lot of time hanging out with TJ Maxx, Marshalls, HomeGoods, and Sierra, and you can make sure you pay your bills in full, then TJX Rewards Credit Card is a good choice for you. For outside the store shopping, most consumers had better not use Chase Freedom ® or Citi ® Double Cash Card cash back of credit Card, etc. Even if you through TJX Rewards Credit Card to buy first TJ Maxx obtained 10% discount is not as good as you get bonuses by other rewards cards so well.

You can also choose to sign up for multiple credit cards. You can get TJX Rewards Credit Card, put it as the auxiliary wallet card. Whenever you use it at TJ Maxx brand store shopping, another credit card is used for other daily needs. This TJX Rewards Credit Card is also a good choice. The main disadvantage of having two credit cards is that they can negatively impact your credit score. Submitting two applications will result in a decrease in your average credit age and an increase in the number of hard queries in your report -- both factors that can have a significant impact on your score. If you intend to apply for another loan within the next 6-12 months, you should realize that this is a factor. But in the long run, that may not matter.

About TJ Maxx card it is worth noting that the other thing is that it APR -- 27.24%. This is significantly higher than most credit cards on the market. It's even higher than what we see on credit cards from other stores. If you get this card, you shouldn't use it to balance your money on a monthly basis. Make sure you always pay your bills in full.

What is a store credit card?

The only difference between store credit cards and regular credit cards is that store credit cards are branded and associated with a specific retailer and its rewards program. Store credit cards offer in-store discounts, allow cardholders to earn and redeem points when making purchases.

There are two basic types of retail store credit card:

-

Open-loop cards: These cards with a Visa, MasterCard or American Express logo in the bottom-right, can be used anywhere.

-

Closed-loop cards: These cards without a Visa, MasterCard or American Express logo only can be used at their co-branded stores, online stores or affiliates.

For example, there are three types of Best buy credit cards, My Best Buy Credit Card, My Best Buy Visa Platinum Credit Card and My Best Buy Visa Card. My Best Buy Credit Card is a closed-loop card, so you can only use it at Best Buy. My Best Buy Visa Platinum Credit Card and My Best Buy Visa Card are open-loop cards, you can use them anywhere that Visa is accepted.

What are the benefits of store credit cards?

Easy to get and can help you to build credit

Because of store credit cards’ high interest rates and low credit limits, they are easy to get with fair or poor credit. If you can use it responsibly, this is an opportunity to build up your score.

A reasonable annual fee

Many great store rewards cards don’t have an annual fee.

Save money at your favorite stores

Store rewards cards have different rewards programs which are great ways to save money, especially you are a frequent customer of that shop. For example, My Best Buy Credit Card offers as much as 5% cash back.

Additional sign-up bonuses and benefits

Many store reward cards attract new customers with a sign-up bonus. What’s more, some store reward cards offer extra benefits, such as discounts, free shipping, a birthday gift and extended return policies.

Open-loop cards can be used anywhere as normal credit cards.

What are the drawbacks of a store credit card?

Low credit limits

This means that you have the risk of going over your credit limits.

High interest rates

Most store credit cards’ interest rates are higher than the industry average (17%).

Closed-loop cards are limited to single store

Many store credit cards can only be used at their store or online shop. But some store credit cards can be used anywhere like normal credit cards, such as Amazon Prime Rewards Visa Signature Credit Card.

Customer service problems

Some store credit cards are not issued by major cards issuers, so the quality of customer service is difficult to guarantee.

Some store credit cards can’t be used for balance transfers

What do you need to apply for a store credit card?

Credit score

Banks approve much lower credit scores for store cards. Therefore, applying a store card is an ideal way for someone with a fair or poor credit score to rebuild his or her credit.

Credit card application

You can apply for a store credit card online, in-store or by email depending on the card. And you just need to fill in your personal information and submit your application. The credit card issuer will consider your credit reports and several different factors when reviewing your application to get an idea of your creditworthiness.

You May Also Like

-

Macy's Credit Card

2 Cards -

Target Credit Card

1 Cards -

Sams Credit Card

1 Cards -

Lowe's Credit Card

4 Cards -

Milestone® Mastercard® - Bad Credit Considered

1 Cards -

Best Buy Credit Card

2 Cards -

Walmart Credit Card

2 Cards -

Victoria's Secret Angel Credit Card

1 Cards -

Old Navy Credit Card

4 Cards -

JCPenney Credit Card

2 Cards - All Credit Cards

About icomparecards

About three-quarters of Americans have at least one credit card,In fact, the average person has 3.4 cards. But whether you have a wallet full of plastic or have never charged a purchase in your life, you should know how to apply for a credit card the right way when the time comes. getting approved for a credit card requires proactive planning that should start long before you apply. That's why icomparecards born, we aim to help you to find the right credit card, and then successfully apply a credit card.

How To Apply For A Credit Card

Credit card applications are straightforward, but you'll need to meet some minimum financial requirements to get approved for the best credit card offers. Learn how to apply for a credit online and what to expect after you click submit.

- Knowing your credit score and what's on your credit report can help you determine what products to apply for. If you have fair credit, for example, you may not want to apply for a card that clearly states that only applicants with excellent credit will be approved.

- If you don't have good credit, you may find it difficult to get approved for a card with a large sign-up bonus and a lucrative reward structure. Each credit card application ends up on your credit report, so the Nerds recommend using our credit cards comparison tool to find a card that fits your credit profile before applying.

- If the card allows balance transfers, you may request to have balances transferred from other credit card accounts to the new card.

- To apply for a credit card in the US, you’ll need a valid Social Security number and a positive credit history. The best rewards credit cards may require at least three to five years of good credit history, and some more than seven.

Never miss a good chance to get a better Credit Card. Get top Credit Card Notifications from more than 100 Credit Card Categories!

We will not share your email in any cases.